While offshore trusts are available in a variety of jurisdictions, few offer the levels of all-round benefit available in the Cook Islands.

While offshore trusts are available in a variety of jurisdictions, few offer the levels of all-round benefit available in the Cook Islands.

The Cook Islands is situated in the South Pacific, around a 4-hour flight from New Zealand and 8 hours from the US West Coast. It is a mature financial services jurisdiction, which has been serving international clients since 1982 and has had international trust legislation in place for over 40 years.

Like many other well-known offshore trust jurisdictions, the Cook Islands offers a suite of features which make it an attractive option: settlors may retain extensive powers without invalidating the trust, trusts and trustees are not subject to local taxes and forced heirship laws of other jurisdictions are overridden, allowing trust settlors extensive testamentary powers.

However, what sets the Cook Islands apart from most other jurisdictions is gold-standard asset protection which affords tremendous peace of mind to trust settlors and beneficiaries. The following protective features are enshrined in Cook Islands trust legislation:

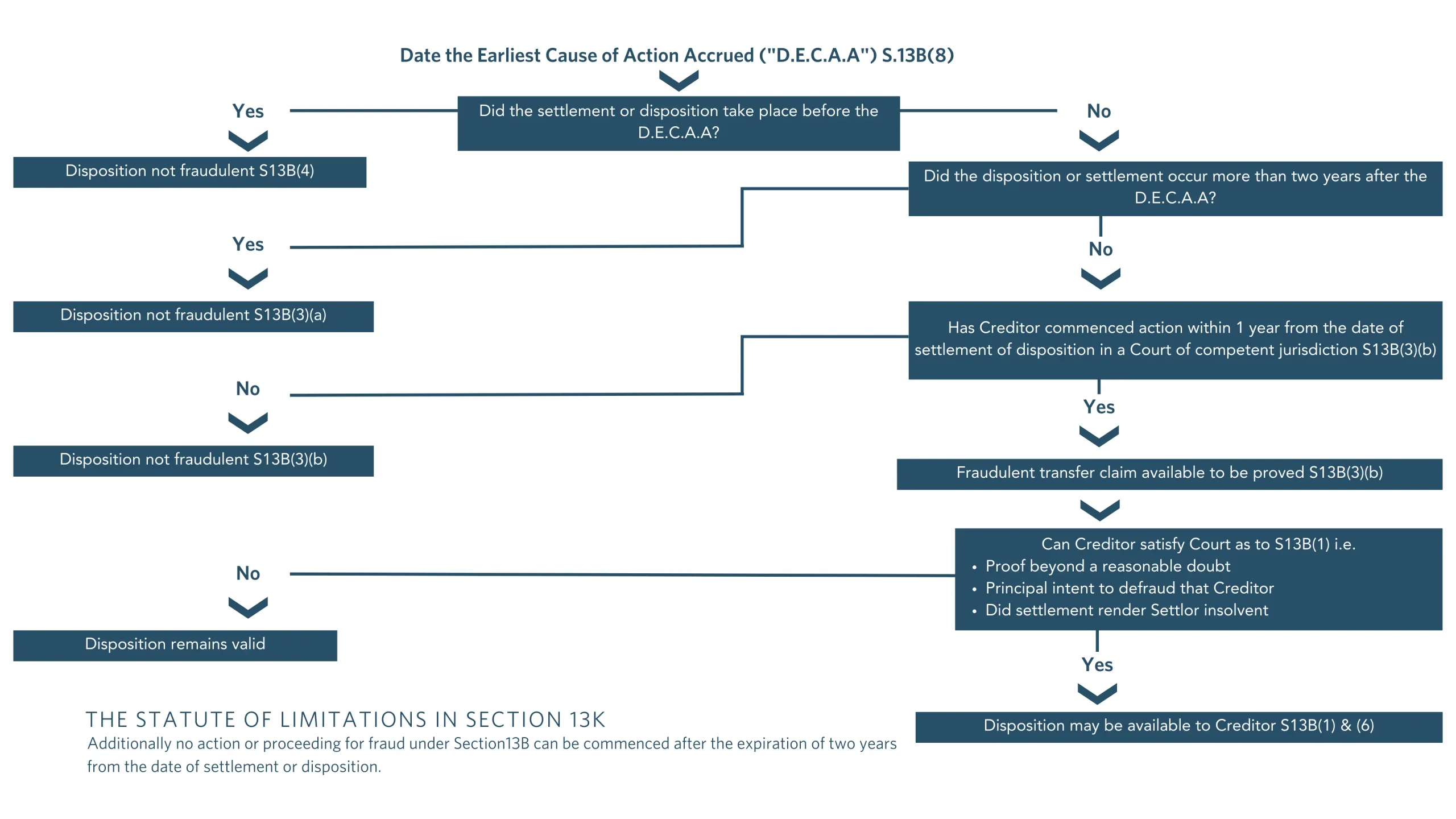

- Assets placed into a Cook Islands international trust before a cause of action accrues – in other words, before anyone has a reason to sue the settlor for something – are completely protected from future creditors.

- Assets settled into trust more than two years after a cause of action accrues are fully protected if no litigation is already underway.

- Where a cause of action has accrued before assets are settled into a trust, the purported creditor must bring a claim relating to that cause of action within one year of settlement, and must bring further proceedings alleging fraudulent transfer in the Cook Islands High Court within two years of settlement. The Cook Islands does not recognize foreign judgments.

- In order to prevail in a fraudulent transfer claim, the creditor must satisfy the Cook Islands court to the criminal standard of proof – beyond reasonable doubt – that the transfer of assets to the trust was made with the principal intent of defrauding that particular creditor, and that it left the settlor unable to meet the creditor’s claim.

The flowchart below illustrates the steps a creditor must take to succeed in a fraudulent transfer claim.

In addition, Cook Islands trust legislation protects settlors’ identities as well as their assets through world-beating privacy laws. These make it a criminal offence for any person to disclose information relating to the establishment, constitution, business or affairs of an international trust without lawful excuse.

In addition, Cook Islands trust legislation protects settlors’ identities as well as their assets through world-beating privacy laws. These make it a criminal offence for any person to disclose information relating to the establishment, constitution, business or affairs of an international trust without lawful excuse.

The Cook Islands does not appear on any international blacklist or greylist. It is tightly regulated without being over-regulated and achieved a Largely Compliant rating in its most recent Financial Action Task Force Mutual Evaluation. Its 8 licensed trustee companies are regularly audited by the local regulator, the Financial Supervisory Commission, to ensure compliance with all relevant laws.

Cook Islands trusts are well known in other offshore jurisdictions and bank accounts in countries including Switzerland can be opened with ease. Cook Islands trusts are often involved in multi-jurisdictional structures, and are frequently established together with a Nevis holding company. Nevis company legislation is also highly protective, making this an iron-plated protective combination. With offices in both the Cook Islands and Nevis, Southpac is able to provide this structure easily and it has been popular among our clients for many years.

The Cook Islands has been keen to innovate and further develop its trust offerings. With this in mind, in 2021 it passed unique legislation allowing the establishment of International Relationship Property Trusts (IRPTs). IRPTs allow couples in a relationship to jointly settle a trust containing jointly or individually owned assets, but ensure that if the couple separates or divorces, those assets must be retained in trust rather than sold off (which would often be at a significant discount) to fund a divorce settlement. Distributions of assets from the trust after the settlors’ separation must be approved by the Cook Islands High Court. This guarantees the availability of those assets to future generations and preserves intergenerational wealth. For additional asset protection, IRPTs can also be dual-registered as Cook Islands international trusts.

To find out more about Cook Islands trusts and the formidable protection they offer, Contact Us

Disclaimer: the article above is for information purposes only. It is not intended to constitute legal or tax advice. If you are planning to establish or place assets into an offshore structure, please consult beforehand with legal and tax professionals in your jurisdiction(s) of tax residence.

This is an edited version of an article originally published in February 2025 on the Outbound Investment Group website https://outboundinvestment.com/the-cook-islands-an-overview-of-this-trust-jurisdiction-and-its-key-benefits/