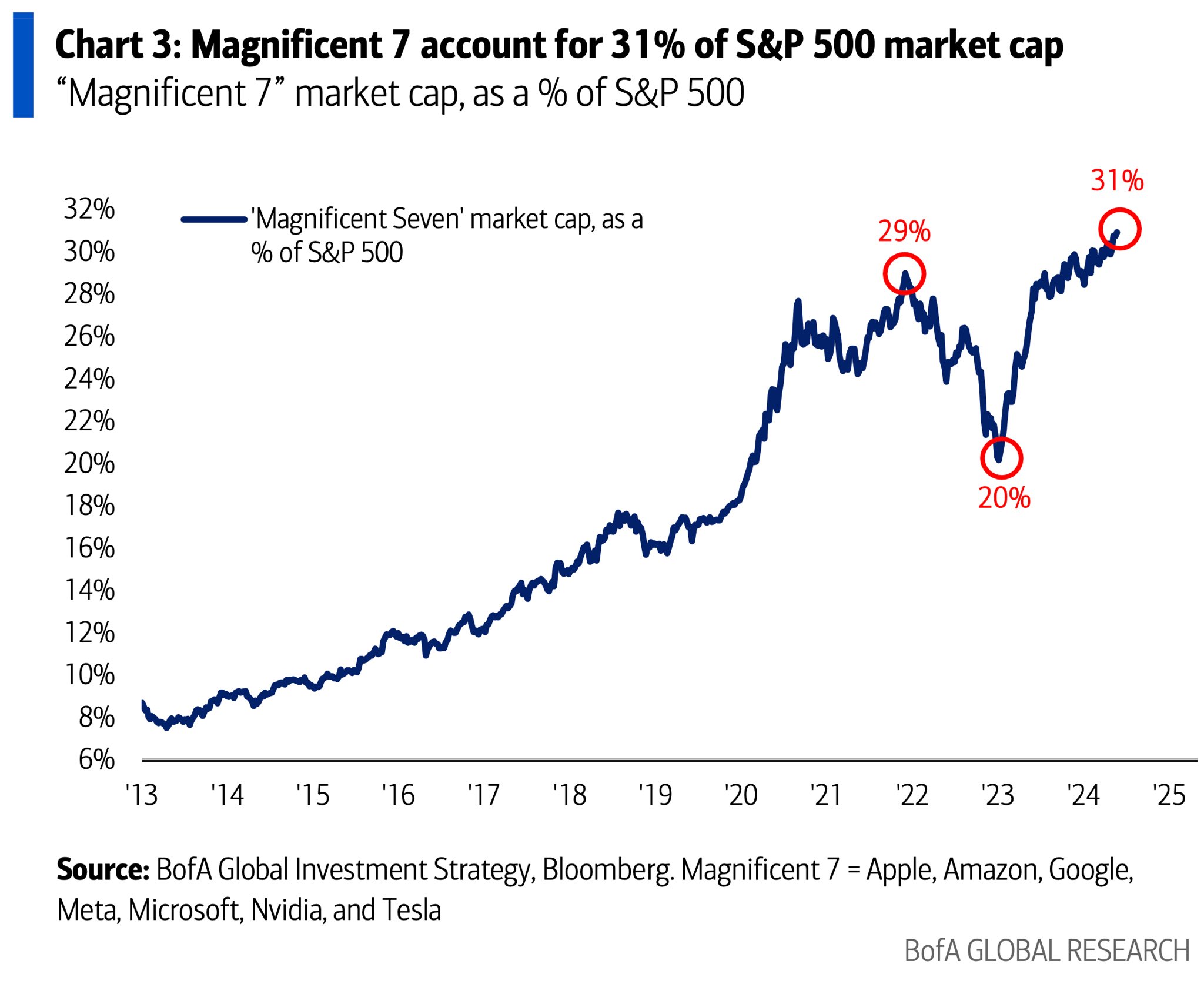

A lot has been made of the growing concentration in the S&P 500, most notably through the rise of the “Magnificent 7.” Technology companies have grown over the last decade to dominate the index, a trend that accelerated through COVID.

A lot has been made of the growing concentration in the S&P 500, most notably through the rise of the “Magnificent 7.” Technology companies have grown over the last decade to dominate the index, a trend that accelerated through COVID.

After COVID, the rest of the market started to catchup, before more recently the Magnificent 7 have pulled away again. However, within the 7, things are no longer equal. The recent rally is driven largely by the excitement around the developing Artificial Intelligence (AI) technology. In this rally, the likes of Tesla (-28%) and Apple (+2%) have been left behind.

In the short term, the earnings impact from AI is likely to be minimal. The reality is that none of these companies have developed it to a level where it can be monetised at this stage. The impact currently is seen through the cashflow statement, where these companies are spending billions to build the infrastructure needed to support the further development of the technology. This is a similar situation to the 1990s when the Information Superhighway (i.e. the Internet we use today) was built. Capital Expenditures rose and the share market started to speculate on which companies would be the winner, the ultimate result was the Dot-com boom and bust. In building the “AI Superhighway”, these companies will be focused on avoiding the mistakes of the past.

From the recent reports of Microsoft (MSFT), Alphabet / Google (GOOG), and Meta Platforms / Facebook (META), we can see the rise in capital expenditures this year.

Source: Base Hit Investing Substack

In addition to the rise this year, the expectation from these companies is that capex will continue to rise:

∙ Meta has stated “While we are not providing guidance for years beyond 2024, we expect capital expenditures will continue to increase next year as we invest aggressively to support our ambitious AI research and product development efforts.”

∙ Microsoft has stated “We expect capital expenditures to increase materially on a sequential basis driven by cloud and AI infrastructure investments.”

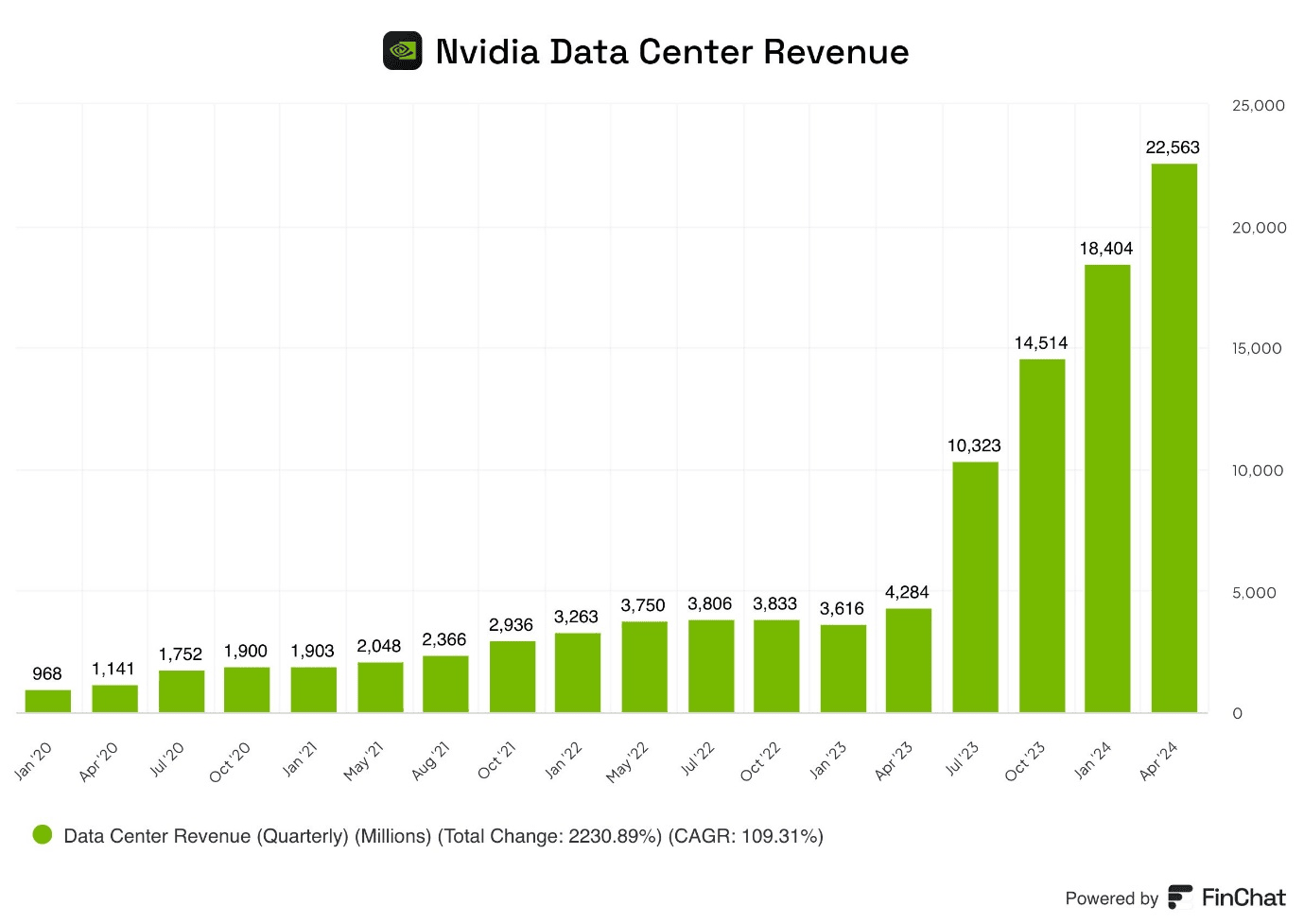

The major beneficiary of this capital spend to date has been Nvidia. Nvidia designs the chips which powers the technology (they only design them, Taiwan Semiconductor Manufactory Company actually makes them). Since the start of 2023, Nvidia’s quarterly earnings have risen exponentially.

With the capex expectations above, it is likely Nvidia’s earnings will continue to grow over the coming years. The question is whether we reach a permanently high plateau at some stage or does the expenditure decline once a majority of these companies build the infrastructure to a critical mass. That is a question that won’t be answered for a few years.

With the capex expectations above, it is likely Nvidia’s earnings will continue to grow over the coming years. The question is whether we reach a permanently high plateau at some stage or does the expenditure decline once a majority of these companies build the infrastructure to a critical mass. That is a question that won’t be answered for a few years.

Going back to the other companies (Google, Microsoft and Meta), this is a significant shift in their business model. Historically, these companies have been software focused with minimal capex, the result being they have had very high returns on capital. The increased capital intensity of the AI technology means these returns on capital are going to drop. Make no mistake, these companies are well capitalised and sit on large amounts of cash, they can afford to go down this route with no material financial risk. However, the nature of their financial returns will change. Google highlights some of the short-term impact in its latest result: “We are very cognizant of the increasing headwind we have from higher depreciation and expenses associated with the higher capex.”

Capex is recorded in the first instance via the cashflow statement, it has no impact on earnings. However, once spent a depreciation charge is taken through the income statement in subsequent periods to depreciate the asset over the course of its useful life. The more you spend in capex, the higher that depreciation charge becomes. As a result, it is highly likely that earnings growth will slow in these companies over the next few years. The question then becomes how they will monetise the AI product and earn a return on the capital spend. That is a question that is yet to be answered.

The reality is at this stage we don’t know who the winners will be from the AI boom (aside from Nvidia), and it will take a few years to find this out. The three companies listed above are spending billions in order to be the first movers and appear to be in the best position. However, back in the 1990s, you could have said the same about the Telecommunication companies rolling out the infrastructure for the internet. Those companies built everything but ultimately had a low return on capital, and the big winners were the likes of Amazon, Google and Facebook who could leverage the infrastructure. These companies will be well aware of that history having been the winners of a similar cycle previously. They will endeavour to keep as much of the benefits as possible, however the past does serve as an interesting warning with regards to the uncertainty around the future.