Back in our 2024 outlook, we asked whether the Federal Reserve had achieved a soft landing for the US economy (see here). At the time inflation was falling and economic growth was slowing but we weren’t seeing any conditions that would indicate a recession.

Back in our 2024 outlook, we asked whether the Federal Reserve had achieved a soft landing for the US economy (see here). At the time inflation was falling and economic growth was slowing but we weren’t seeing any conditions that would indicate a recession.

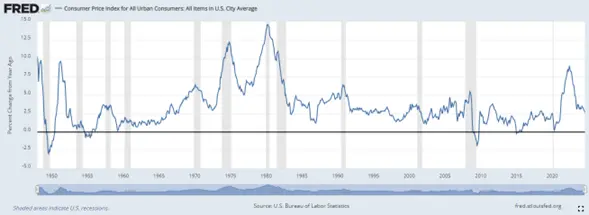

Those themes have continued. Inflation is at 2.5%, slightly above the 2% Fed target.

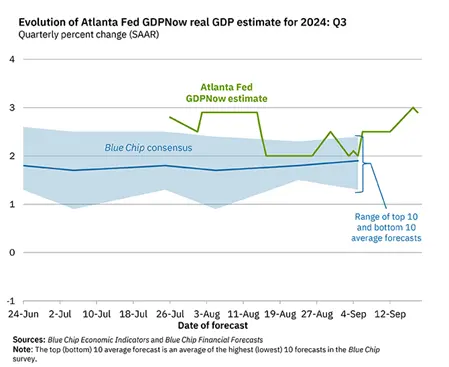

GDP growth in the 2nd quarter was 2.8% annualised following 1.4% growth in the first quarter. The Atlanta Fed GDPNow estimate has the third quarter GDP at 2.9%. This is what economists describe as “below trend growth” and is a much more desirable outcome than a recession if it can be maintained.

The slowing economic growth has seen the FOMC cut rates with the focus now on that measure as opposed to inflation. From their point of view, the job of getting inflation under control is now complete and the focus is on avoiding a recession.

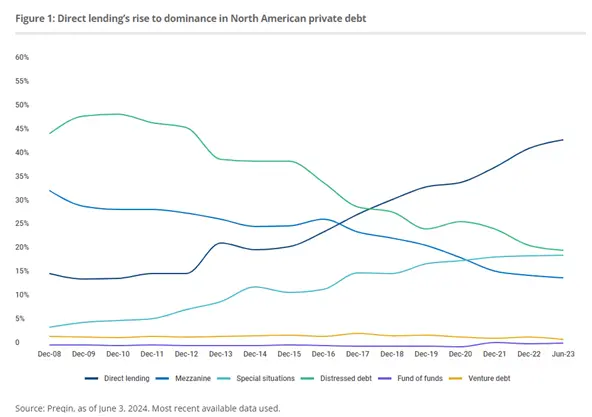

Similar to the start of the year, recessionary forces aren’t obvious. We wrote about residential construction as a key driver of economic activity back in our 2024 outlook, at the time it had stabilised, and it has continued to do so. There are some concerns in the public domain around areas of the financial system, most notably the rise of Private Credit and the remote working impact on Commercial Real Estate (CRE). There are no signs of instability from either of these currently, however the CRE sector has a record amount of maturities due next year (c. $925 billion according to Cambridge Associates) that will test the market. Meanwhile, Private Credit continues to grow and take market share at the riskier end of the credit market.

Whilst there are interesting trends in those two sectors, there is no immediate concern. The situation remains that we have slowing economic growth and stable inflation, i.e. a soft landing.

What does this mean for investors? Firstly, cash is becoming less attractive. In the last few years, we have been able to get rates above 5% in Fiduciary Deposits and T-Bills, those days are now gone.

Bonds have rallied on the back of the Fed pivot, the US 10-year rate has fallen from close to 5% a year ago to below c. 3.8% now. The FOMC “dot plot” which looks at board members’ forecasts of interest rates, suggests a longer term rate of 3%, so there could be further upside for bonds to come. This dot plot can be seen below. Research from David Rosenberg at Rosenberg Research backs this assertion up and shows historically only approximately half of the bond rally has been completed at the time of the first interest rate cut.

Source: FOMC Summary of Economic Projections, September 2024

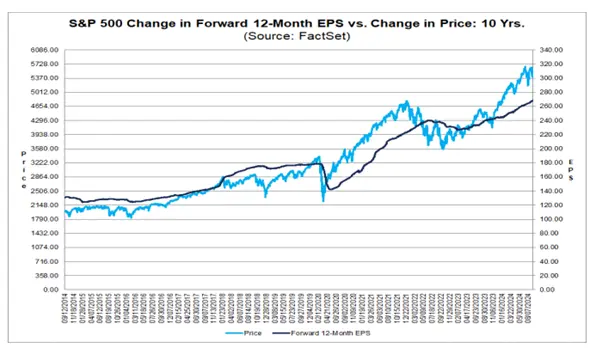

The direction of the equity market post the first rate cut is usually less predictable. Making the situation even more challenging this time around is that the S&P500 is close to record levels. Typically a rate cutting cycle will start in a time of economic weakness that sees a depressed equity market. So far in this cycle, there has been little to no impact on earnings and hence, the equity market has remained elevated. After a slowdown in 2022, earnings have returned to a growth trend and the S&P 500 has risen over 20% year to date.

Year to date, all sectors within the S&P500 are in positive territory. Unsurprisingly, the leading sector is IT, up 28.3%. Energy is the laggard, only up 6.8% as commodity prices weigh on those companies as well as those in the Materials sector.

In the last three months, we have seen a significant rally in the interest rate sensitive sectors with Utilities and Real Estate both up around 17%. As the bond rate falls, these stocks benefit.

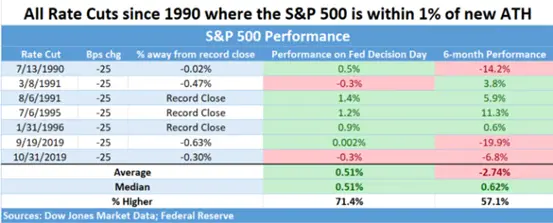

Is there a guide from history about what happens next? Well, there are 7 times since 1990 where the FOMC has cut rates with the S&P500 within 1% of a record high. In 4 of those cases, the index was higher 6 months later, however the average return was -2.74%. Therefore, it is probably fair to say that history is not helpful.

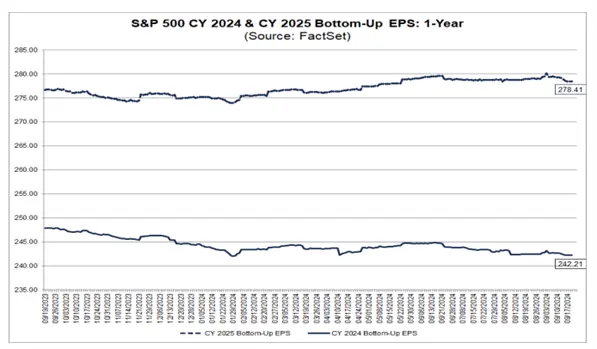

Ultimately, it will all come back to earnings. At this stage, the expectations for 2025 earnings are high. The expectation is for 14.9% growth on aggregate across the entire market. This number has been rising since the start of this year.

The expectations across all sectors is for earnings growth in 2025. IT and Healthcare are expected to lead the way, however some of the more cyclical sectors are also expected to contribute. Earnings for Materials (+18.4%), Industrials (+16.1%) and Energy (+11.2%) are all expected to be materially higher. This is a little inconsistent with the current GDP growth rates and the expectation of continued rate cuts. If the Fed is right, then the market is most likely wrong on 2025. In that scenario, earnings will be revised down (they are more often revised down that up) and the rally will stall.

Of course, stalling in some sectors can be masked by others, which we saw in 2023 with the IT sector. To this end, the AI revolution / hype continues. The concentration of the index within a handful of names focused on this theme (as reported here) continues, and the rise of Nvidia continues to be a key driver of the equity market (up 156% year to date).

Source: Google

If earnings are revised down in some sectors, we will see sector divergence but the ultimate driver of this bull market has been and will most likely continue to be IT. It is that sector that will dictate the overall direction of the market.

Disclaimer: The above contains the opinion of the author and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.