2025 Investment Outlook – Is It Time to Look Beyond the US?

2 March 2026

A year ago, we looked at the US Economy and asked whether the Federal Reserve had achieved a soft landing. At the time we wrote “The signs at this stage are that the FOMC have managed to tame inflation without pushing the economy into a recession, hence have they achieved the near impossible “soft landing.”” A year on that conclusion looks solid with GDP having grown at a 3% annualised rate over the last 6 months and inflation running at 2.9% down from a peak of 8.5%. From a sharemarket perspective, the result has been a second consecutive year of over 20% gains. It is the first time since 1998 that we have seen that occur.

In 2025, we are posing a different question, from an investment perspective, is it time to look outside the US? In posing this question, we want to clarify that we are looking purely at the sharemarket and not the economy. Whilst the sharemarket should follow the economy over time, there are periods where speculation drives a disconnect between the two. We are potentially at one of those points.

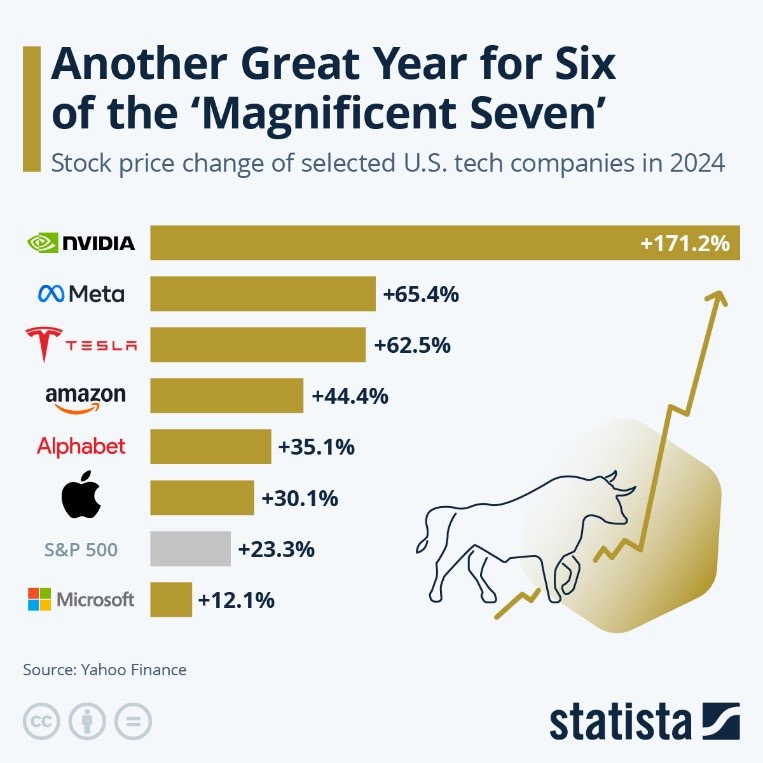

The reason behind that disconnect was on show last week at Donald Trump’s inauguration with some of the most notable attendees being the CEOs of Google, Meta, Amazon, Apple and of course, Tesla. These are five of what have been called the “Magnificent Seven”. These seven have been the key driver of the rally we have seen and this has led to a significant concentration risk in the US sharemarket.

This concentration risk has reached historical levels. The top seven stocks have now become 33% of the S&P500 and that has doubled over the past five years. Prior to this, the highest concentration of the top seven companies in the last thirty years was 22%. That level was reached in 2000, two months before the peak of the “Dotcom” bubble.

The attractiveness of these stocks has also led to significant capital flows to the US. US stocks now comprise over 70% of the global market whilst the US economy is 23% of GDP. The US dollar is also at high levels, with the US dollar index (DXY) trading near its highest level since 2002.

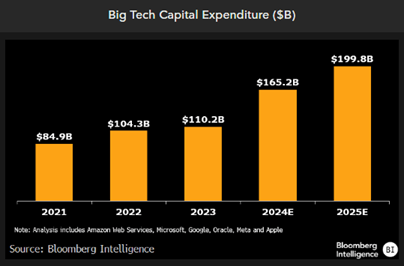

The rally of these seven stocks has been driven by two factors, initially by low interest rates from the pandemic and then secondly the rapid innovation in the field of Artificial Intelligence (AI). In recent years the big tech companies, primarily Amazon, Microsoft, Google, Meta and Apple, have been investing heavily in the infrastructure required to develop this technology further. This trend will continue in 2025.

To add to this, Trump has announced the Privately funded $500bn Stargate project, which just adds to the expectations. The issue with all this capital expenditure is that to date, no-one apart from Nvidia which is essentially selling the picks and shovels to the industry, has worked out how to make money out of AI.

Back in 2023, when this theme started to emerge, we wrote an article entitled “The Birth of an AI Bubble” where we saw the signs of a bubble arising. Fast forward two years and those signs are more prominent.

When we look at the history of bubbles, they are driven by innovation. In recent history, the “Dotcom” bubble was driven by the rollout of the internet, and in the distant past we had examples such as the “South Sea” bubble in the early eighteenth century focused on the new colonies and the railway mania of the 1840s. In all of these cases, the technology has lasted, we have the internet, and the UK has its railways. In many ways, the bubbles were crucial to the development of those technologies as it attracted capital. To that point, we have no doubt the technology in the AI space will last and become more prevalent in our society. However, we do question the certainty with which markets have appointed the seven victors of the AI age.

When caught up in innovation, investors can forget how quickly the world changes. There are seven stocks now that everyone is buying, however the sustainability of their dominance is questionable. If we look at the top twenty companies in the S&P500 from twenty years ago, only six of them remain. The only one of the magnificent seven that was in the top twenty back then was Microsoft. When you pay the high multiples that investors are paying now, you are betting on these companies profiting decades into the future and based on recent history, forecasting that far into the future is impossible.

In saying all of this, timing is important in financial markets and being early is akin to being wrong. Whilst we might be in a bubble, there is no telling when and how it will break. What is important though is risk management and from that end, it appears to be a good time for US investors to consider allocating some capital offshore. Offshore investing has not been a good place for US investors in recent years with capital flowing into the US, however “reversion to the mean” is a powerful force and at some point, recent trends will reverse.